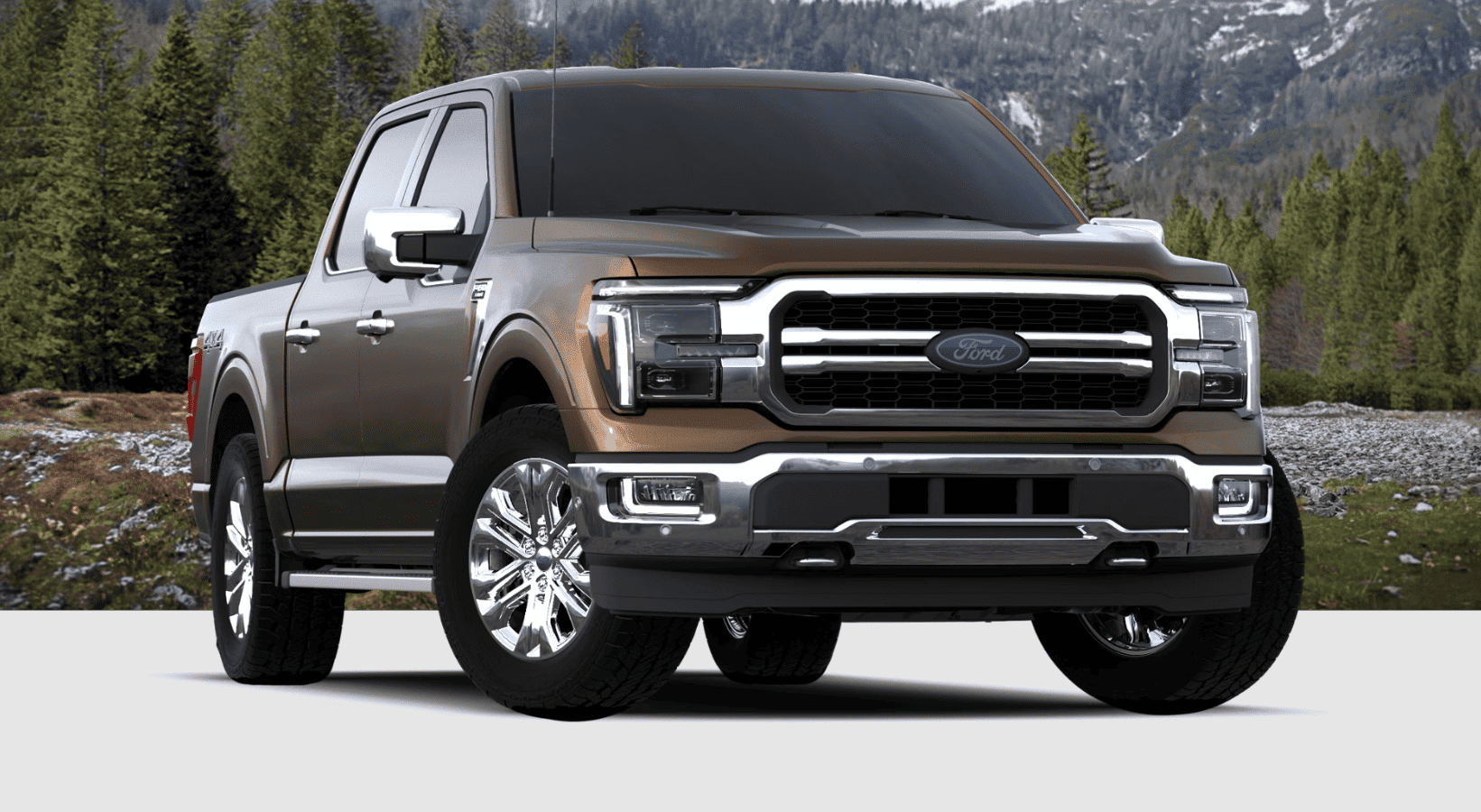

Business owners looking to purchase a truck, like the Ford F-150, can benefit from Section 168(k) of the IRS tax code. This regulation allows businesses to claim bonus depreciation on qualifying vehicles, making it easier to offset the cost of vital equipment. At O’Brien Ford of Shelbyville, we’re here to help you maximize your savings.

Why Choose the Ford F-150?

The Ford F-150 is a top choice for businesses due to its durability, versatility, and capability. With its powerful towing capacity, customizable configurations, and advanced technology, it meets the needs of a wide range of industries. It’s the perfect choice to bolster your workforce.

What Is Section 168(k)?

Section 168(k) provides a valuable tax incentive for business owners by allowing them to deduct a significant portion of an eligible asset’s cost in the first year of purchase. This bonus depreciation applies to vehicles like the Ford F-150, which meets the weight and use requirements set by the IRS.

For the Ford F-150 to qualify, it must be used more than 50% of the time for business purposes. Once these criteria are met, business owners can deduct up to 100% of the vehicle’s purchase price during the tax year in which it was placed into service.

How to Take Advantage of Section 168(k)

To claim this deduction, keep accurate records of the business use of your Ford F-150 and provide documentation of its purchase price. Additionally, consult a tax professional to ensure compliance with IRS requirements. At O’Brien Ford of Shelbyville, our team is ready to assist you in finding the right truck for your business needs.

Save on Your Ford F-150 Today

Discover how Section 168(k) can help you save on a Ford F-150 for your business. Visit O’Brien Ford of Shelbyville to explore our inventory and speak with our team about financing options and eligibility requirements.